How to Measure and Optimize Key Metrics in the SaaS Industry? (Part 5)

11. The Importance of Customer Segmentation

Every SaaS company, once it reaches a certain stage, comes to realize this: not all customers are created equal.

For example, selling to large enterprise clients is usually more difficult, but once a deal is closed, the contract value is often much larger, and the churn rate is typically lower. We need to find out which types of customers bring us the greatest returns. This requires us to segment our customers and calculate unit economics for each segment. Common segmentation approaches include grouping by customer size or vertical industry.

Although calculating the unit economics for each segment takes time and effort, it is extremely valuable for gaining deeper insights into your different customer types. It allows you to understand which parts of your business are performing well and which parts are underperforming. This way, you not only know where to focus your resources, but also where to develop new product features or apply different marketing strategies.

For each customer segment, we recommend monitoring the following metrics:

● ARPA (Average Revenue Per Account per month)

● Net Monthly Recurring Revenue (MRR) Churn Rate

● LTV (Customer Lifetime Value)

● CAC (Customer Acquisition Cost)

● LTV / CAC Ratio

● CAC Payback Period

Brad Coffey, HubSpot:

At HubSpot, we saw some improvements in unit economics when we started breaking out our business and calculating the LTV to CAC ratio for each role and applying that to our go-to-market strategy.

Calculating LTV:CAC by segment can be challenging, especially on the CAC side. As soon as you try to break down spend, you’ll run into questions like, “How much of our marketing spend goes to this segment?” “How much in sales costs?” By comparison, it’s relatively easy to calculate CAC at a high level—just sum up all sales and marketing costs over a time period and divide by the total number of customers acquired.

We solved this by allocating marketing spend based on headcount and sales effort—but it’s not a perfect system. What matters most to us is: (1) all costs must be considered—there’s no such thing as a free lunch, and (2) consistency over time is key—improving your measurement process is more important than the absolute values themselves.

12. Breaking Down Funnel Metrics

What are the key metrics in a sales funnel?

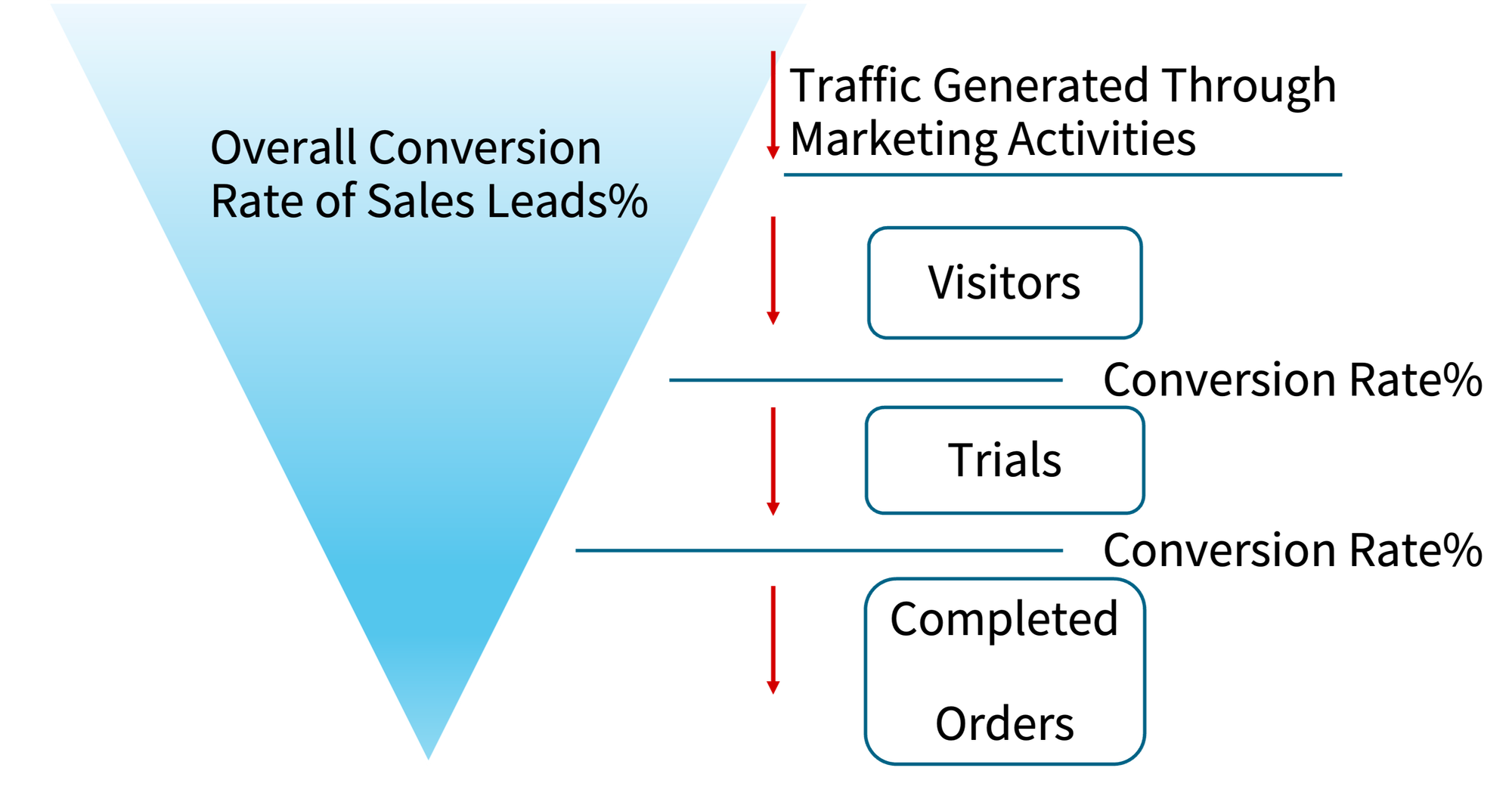

Different companies have different metrics depending on the specific steps in their funnel. But regardless of the sales process, the methodology for measuring each step and the overall funnel is the same. For each step, you need to track two things: the number of leads entering the top of the funnel, and the conversion rate to the next step. See the diagram below:

This diagram illustrates a simple three-stage sales process:

● Marketing activities drive visitors to the product’s website;

● A portion of those visitors sign up for a trial;

● A portion of the trial users end up purchasing the product.

So, the three metrics to track are: visitor data, trial sign-ups, and paying customers. We need to understand the conversion rates at each of these stages, with the ultimate goal of improving these rates.

13. Using Funnel Metrics for Long-Term Planning

Another key value of understanding these conversion rates is that they help you make data-driven forecasts.

For example, if your company wants to reach $4 million in sales next quarter, you can work backward from that number based on your funnel conversion rates. You can estimate how many product demos or trials you’ll need, then how many sales reps you need to deliver those demos, and finally how many qualified leads you need to generate. These essential planning metrics will shape your team size and marketing budget.

14. Understanding Sales Capacity

In many SaaS companies, sales reps play a critical role in closing deals. In such cases, the number of high-performing salespeople (i.e., sales capacity) becomes a crucial factor in achieving your revenue targets.

Once sales targets are set, you need to work backward to determine the sales capacity required to meet them. I’ve seen many companies miss their goals simply because they didn’t hire enough high-performing sales reps early on. Some companies even experienced a sudden plateau in growth after several years of rapid expansion—later realizing that they stopped hiring new sales reps after hitting a headcount of 20.

It’s important to note that not all new hires will meet your productivity expectations. This should be factored into your hiring targets. Typically, 25%–30% of new sales hires underperform, though the exact percentage varies by company. When calculating sales capacity, if a new hire is expected to reach only 50% of the target quota, they should be counted as half a rep in capacity planning.

Another critical metric to monitor is the number of leads each sales rep needs. If you’re adding reps, make sure you have a clear plan to generate enough qualified leads to support them.